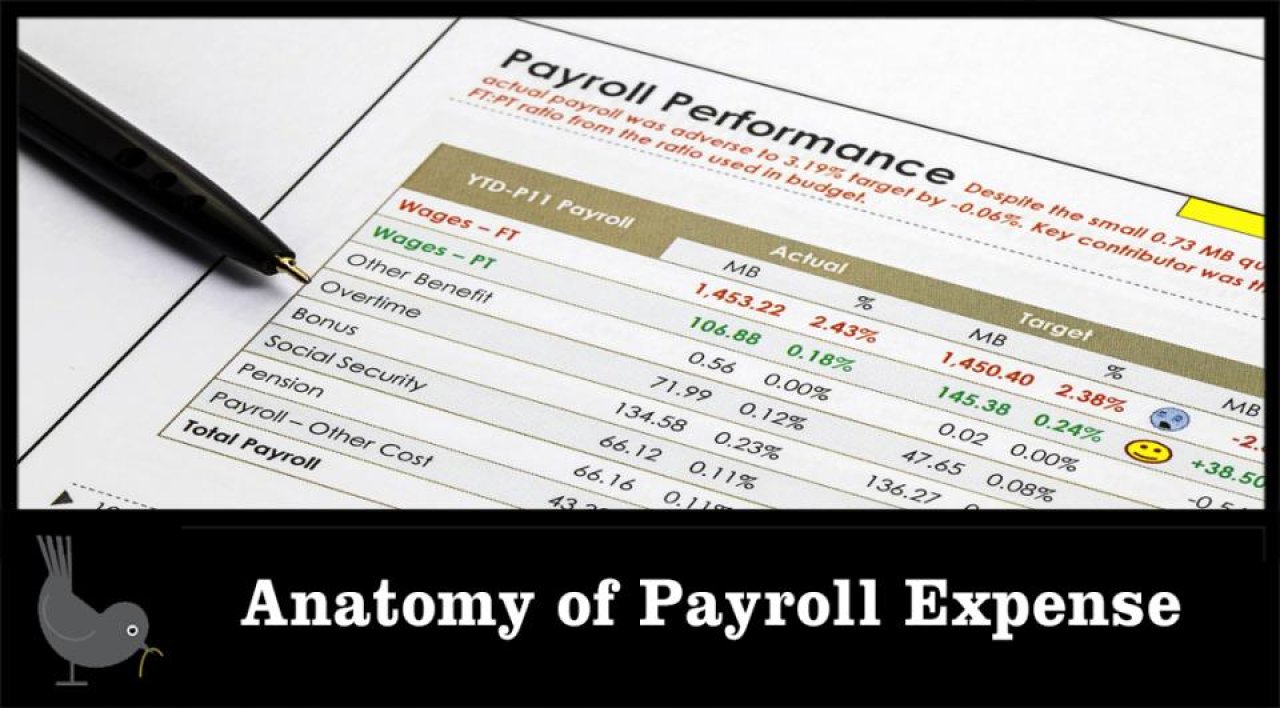

Anatomy of Payroll Expense

Payroll buys a complex array of talent, thinking and behavior. People have ideas, dreams, passion, skills, courage, imagination and other purely human qualities that give a business life and meaning. People are also the most challenging aspect to leading and growing a successful company - especially in a service business where quality and excellence is dependent on how well the service experience is executed.

Here is my No-Compromise Leadership anatomy of payroll expense:

- It’s about controlling it: Because it’s your company’s largest expense, payroll truly is the elephant in the living room. If you don’t keep it under control, payroll expense will wreak havoc on your cash flow and profits. The Strategies benchmark for service payroll (hands that do the work) is 30 to 35 percent of gross revenue (service + retail sales). Administrative and guest services should be +/-10%. If you pay commission on services and your payroll is above the benchmark, you’re in a dicey situation, because you cannot lower your payroll percent without tampering and lowering commission rates. Tamper with commission rates and you’re going to get employee resistance. That’s just one of the reasons that Strategies uses the Team-Based Pay (TBP) method of compensation. TBP is an hourly + team bonus pay system that is based on overall performance ... not just sales.

- It’s about time: The payroll expense line items on your Profit & Loss Statement represent the purchase of your employees’ time. The purchase of time gives you access and use of your employee’s talent, skill, creativity and other abilities. It is the company’s responsibility to utilize that time effectively and efficiently. That means the proper planning and coordination of how time is allocated to different tasks. Buy too much time and you put stress on cash flow and shrink profit. Buy too little time and you compromise the ability to meet demand and deliver quality results. Time is a precious commodity that requires constant attention.

- It’s about productivity: You buy time to produce results. Your company’s productivity rate is a primary critical number. It is the ratio of time available to time used. The Strategies benchmark for productivity rate is 85 to 90 percent. A low productivity rate means that you purchased more hours than you can effectively utilize and that payroll dollars are being wasted. A productivity rate below 70% is a red flag. Below 65% it is officially a serious productivity problem.

- It’s about plugging leaks: Payroll expense is highly prone to springing leaks in the form of employees that are working below time standards (looking busy but are actually working at a snail’s pace), taking excessive work breaks, avoiding work and just plain old wasting time. Using computers for shopping, Facebook and other social media sites. Using smart phones for excessive texting and going online. Poor scheduling, padding hours and unnecessary overtime can bloat your payroll costs. If you don’t have oversight, performance policies and procedures, your payroll expense leaks can become substantial.

- It’s about investment: Payroll is an investment in your employees. Like any worthwhile investment, employees need continuing education to develop and refine skills. Employees need to know how they’re doing through scheduled performance reviews and one-on-one sessions. Employees also need to see and understand their growth opportunities and career paths. Most of all, employees need to know they are appreciated for their contribution to the company. If your approach to protecting your payroll investment is to push for more performance out of your employees and nothing more ... the resulting employee turnover is driving up your payroll costs. A company that invests and cares for its people is a company that maximizes its payroll investment.

- It’s less about the money: Money doesn’t buy employee loyalty, passion and commitment to your company, its culture and its vision. Money buys “mercenaries” that move on to the next dollar. People work for opportunities and fair pay. People deliver their best performance and productivity when there is meaning and purpose in their work. People thrive in team-based cultures where the energy and urgency to win is a shared experience. Money and profit is an outcome derived from what the company stands for in terms of core values, fairness and integrity. Payroll is truly more than expense to be managed and controlled ... it is something extremely personal because it is about peoples’ lives. Given the proper attention, planning and financial discipline, a company’s payroll expense should be a source of pride. If not, you’re missing what business is all about.

- - - - - - - - -

Please share your thoughts with me about today's Monday Morning Wake-Up. Click below to comment.

Pass this e-mail on to your business colleagues, managers and friends. They will appreciate it.

Comments (2)

To the strategies.com owner, Your posts are always well written and informative.

Posted By: Hiram Wetzel•February 24th 2023, 11:40:00 pm

Thank you for informing us that when the business has people working for it, payroll will always be its largest expense category. I'm opening a restaurant soon, and I was wondering how I should go with the payroll once I find staff to hire. I'll keep this in mind while I look for a service provider to hire for payroll management soon.

Posted By: Elina Brooks•February 15th 2023, 5:25:00 am

Leave a Comment